P B P C O R P O R A T E R E L A T I O N S

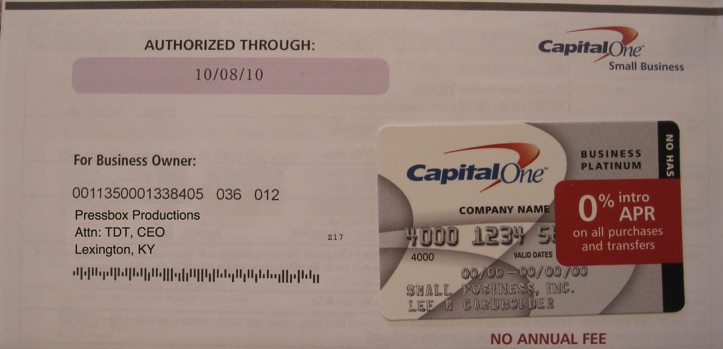

One such recent proposal had the international snail mail processing firm of Pitney Bowes (NYSE: PBI) offering the unheard of sum of $480 (US) just to secure the honor of providing “assistance” with the overwhelming task of handling PBP’s “postage” needs.

After a thorough review & vetting process & an exhaustive cost vs. benefit analysis, conducted by the crack PBP accountants, Cook, Books & Hyde LLC, the net savings are estimated to be approximately $2.16 billion (US) annually. On news of the inked agreement between the two firms, PBP (NYSE: PBP) closed at today’s bell up $22.47 (US).

Being a huge multinational conglomerate of companies certainly has its perks. Major corporations are constantly battling to develop business relationships with PBP & often proffer lucrative financial terms just to include PBP on their list of clientele.

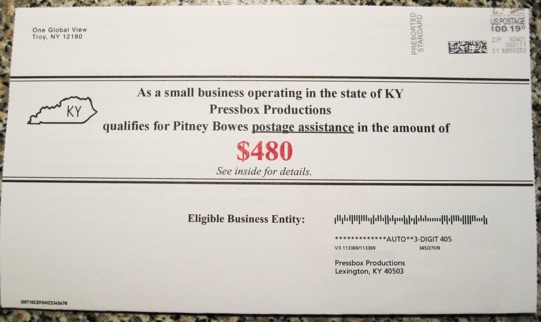

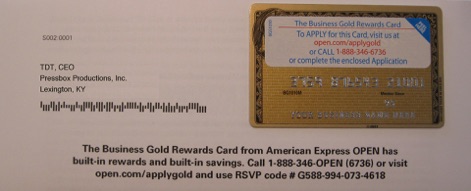

American Express, (NYSE: AXP) the gold standard of corporate credit, has made so many repeated attempts to entice PBP to accept its Business Gold Rewards Cards, PBP’s crack legal team of Dewey Cheatem & Howe LLC were forced to issue a cease & knock-it-off order to stem the paperwork tsunami. Thousands of AmEx credit offers arriving daily in PBP branches around the world were interfering with processing official PBP correspondence, requiring additional mail room staffing & equipment (see Pitney Bowes above). Increased trash disposal & recycling costs were 13.2% (US) higher than the year-ago quarter & resulted in a one-time write-down of $3,500,013 (US).

What’s more valuable than Gold?

Platinum Baby!!!!

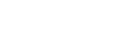

Not to be outdone by its larger & more established competitors, Capital One Financial, Small Business Division (NYSE: COF) offered PBP the unheard of terms of 0.0000% APR (US) PLUS........ No Annual Fee on its ultra-rare Business Platinum Card. One of only 5 US corporations to be offered their BPC, PBP CEO TDT continues to decline all offers for credit in compliance with PBP’s corporate policy of paying for all purchases of $17,000,000 (US) or less from petty cash.

Pictured here are just a couple of the thousands of overworked mail room supervisors in PBP offices around the globe. Lotta Papercut (left) from PBP’s Koala Lumpur Quality Assurance office & Gawen Postal (right) from the PBP Risk Management Department in Duluth, illustrate the overwhelming deluge of credit & other unsolicited business offers that a typical Pressbox Productions division receives on a weekly basis.

There’s one in every crowd!

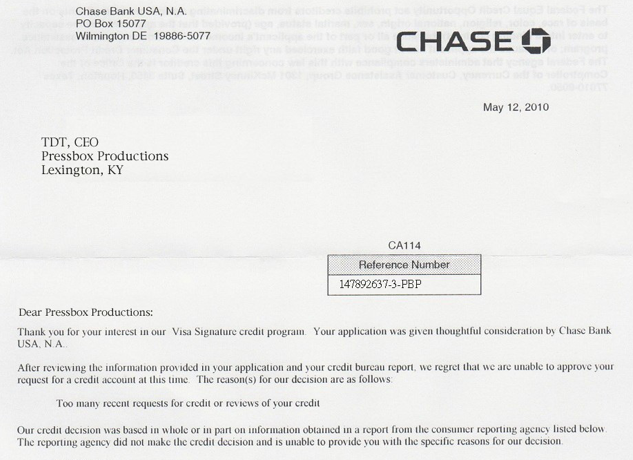

Despite 40 decimeters of rock solid financials & 536 consecutive quarterly results that out performed the street’s expectations by an average of 17.24% (US), even PBP can apparently fall victim to today’s tight credit market. In this letter from the good folks at Chase Bank USA NA (so whadda ya think NA stands for, Non-American, Nefarious Activity, Nincompoop Accountants.....) they regretfully decline PBP for a credit line they never requested. That’s really rich, PBP never even submitted an application but still got rejected. Ouch!!!! If PBP didn’t have 37 billion in cash reserves sitting in various Swiss bank accounts (115 times the total market cap of said Nancy Boy Chase Bank outfit) this rejection would really sting. Boo Hoo!

In what financial pundits are describing as the most colossal bidness mistake since the Apple Computer Board fired a certain Steven Paul Jobs back in Q2 1985, this rejection letter will surely live in corporate infamy.

“Freedom is just another word for nothing left to lose”, sang Janis & apparently the folks at JP Morgan Chase agree. Barely a week after their faux pas of declining credit to Pressbox Productions, came this offer of their Freedom Card. With 5% cash back & no annual fee, the bean counters at PBP quickly realized how to capitalize the obviously desperate attempt by the Chase credit approval pin heads to save face.

PBP accounting departments around the world quietly opened 1,776 Freedom accounts, purchased 1.37 billion (US) of goods & services, paid off the balances & closed the accounts, netting PBP a cool 68.5 million (US) in cash back payments.

It’s not nice to fool The Pressbox!

In related news, JP Morgan Chase & Company (NYSE: JPM) closed Friday at a 52 year low of $1.27 (US), down $187.91 (US).